Biweekly Moonbeam News: 4/4/2023-4/10/2023

Your Go-To Source for Shedding Light on All Things Happening in the Moonbeam and Moonriver Ecosystem. Week 4/4-4/10

Downtown Moonbeam Newsletter is your go-to source for everything happening in the Moonbeam and Moonriver ecosystem. Our mission is to create a vibrant and engaged community around Moonbeam, by sharing the latest information, insights, updates and memes! We carefully handpick the most relevant information so that you don't have to spend hours scrolling through countless Twitter accounts. Whether you're a OG crypto-head or new to the space, Downtown Moonbeam will be your reliable companion to stay up-to-date with the latest developments in the Moonbeam ecosystem. Be parts of our community and let's explore the wonders of Moonbeam together!

MOONBEAM and MOONRIVER Network Updates:

Moonbeam Referendum

The Moonbeam community has approved a 1st round of Ecosystem Grants, providing funding for projects to use for user adoption and liquidity programs on the Moonbeam Network. The grant process was improved based on community feedback, allowing for earlier community involvement and a deadline-driven submission process. The following grants were awarded and their proposed uses:

Beamswap: 657,900 GLMR to bring more users to the Moonbeam ecosystem through liquidity for its new product, Beamex.

DAM Finance: 728,550 GLMR to create incentivized pools with concentrated liquidity for its stablecoin on Polkadot.

Prime Protocol: 1,337,100 GLMR to position Moonbeam as a cross-chain DeFi hub through collaborations.

StellaSwap: 1,677,150 GLMR to deepen liquidity on its stable AMM and drive the adoption of its concentrated liquidity protocol.

Two proposals (DoDAO and Zircon Finance) did not receive the minimum allocation of 609,756 GLMR and were not included in the on-chain vote. The remaining 69,300 GLMR was reallocated to Community Grants.

The Moonbeam Foundation grant funds for this period were divided into two tranches, with a maximum of 2 million GLMR tokens distributed per project. The second tranche will follow a similar process before its July start date. The original proposals from each project can be accessed through the following links:

Moonriver Updates

The Moonbeam Foundation has secured a new Kusama parachain lease, ensuring that Moonriver can continue to operate as a parachain without interruption. This extension guarantees the sustained, seamless operation of Moonriver as a parachain, offering reassurance to the community that their transactions and assets remain secure and reliable. The Foundation's commitment to stability and security is evident in their ability to self-fund this slot extension and their continued dedication to providing the best possible service to the community.

Upcoming Event

The Art of Web3, Hosted by Moonbeam and MuseumWeek. The event is set to take place on April 14th, 9 AM ET. So be sure to mark your calendars.

https://twitter.com/MoonbeamNetwork/status/1642939085672136718

Proposal

Proposal for HRMP Communication and CFG Listing between Centrifuge and Moonbeam.

Moonbeam Accelerator Programs

The Moonbeam Accelerator Program helps early and growth-stage startups grow by strengthening their core skills in areas like technology, business, marketing, finance, and fundraising. The 1st cohort includes 11 startups, including AirLyft, Evrloot, GLMR Apes, BrainDex and many more. The program provides resources and support for these startups to reach their full potential and succeed in the industry.

https://moonbeamaccelerator.com/companies/

Community

Community Initiatives. Request for Funding UnitedBloc's RPC Endpoint Maintenance. The TL;DR: A community member has submitted a funding request to support UnitedBloc, a team of 13 individuals, in operating and maintaining two RPC endpoints for Moonriver and Moonbeam from December 23, 2022, to March 23, 2023. The proposal, framed as a reward for the group's dedication, seeks $23,400 in MOVR from the Moonriver treasury reserves. This funding will ensure the vital RPC endpoints remain operational and accessible to the community, facilitating the network's seamless functionality..

https://forum.moonbeam.foundation/t/proposal-xx-payment-request-for-unitedblock-rpc-services/737/7Kapa.ai is now available inside the Moonbeam Discord. Kapa.ai is trained on various Moonbeam resources and can answer complex questions related to setting up an XCM channel and checking transaction finality.

https://moonbeam.network/blog/kapa-ai-introduction/

DTMB Updates and Announcement:

Downtown Moonbeam successfully managed the #MoonbeamIgnite campaign with approximately 5,200 participants. The campaign was made possible with the participation of the Moonwell, Stella, DAM Finance, Prime Protocol, and Squid teams.

From April 7th to April 10th, 2023, Downtown Moonbeam will distribute gift cards to 100 Master Voyager discord members as a token of appreciation. This distribution is made possible through the generosity of the CEO of TF Alpha DAO.

https://twitter.com/dtmb_xyz/status/1644013164319715328

10 new projects from April 1st to April 6th, 2023 have been added to the Downtown Moonbeam curated lists, providing the community with updated information on the latest projects in the ecosystem.

https://www.dtmb.xyz/

Ecosystems Updates:

Recently Launched On Moonbeam & Moonriver Ecosystem

Bounce Finance Supports Moonbeam and Moonriver to expand its decentralized auctions offerings

HashKeyDID has made its debut on the Moonbeam Network.

Project Updates on the Moonbeam and Moonriver Ecosystem

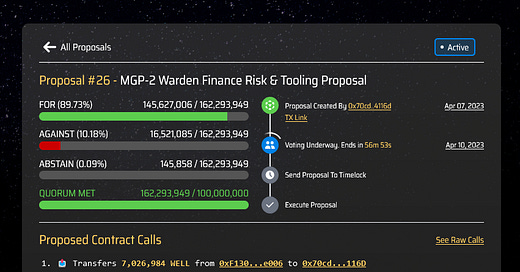

Warden is offering support to Moonwell in two essential areas, tooling and infrastructure, and risk management. As part of this support, Warden is providing free access to its risk and analytics platform to help advance the development of Moonwell on the Base chain. Furthermore, Warden will provide recommendations for governance parameters and onboarding support, enhancing the risk tooling for the community and further decentralizing risk management. The proposal has already been discussed with stakeholders from Lunar Labs.

Warden proposal can be read here: https://gov.moonwell.fi/artemis/proposal/26

Beamswap

Beamex aims to offer a more advanced trading experience than Beamswap by introducing features such as leverage trading with up to x50 leverage, low fees, deep liquidity, low liquidation risk, minimal spread, and zero price impact.. The trading price of assets on Beamex is determined based on the aggregate of top price feeds of major CEXs, which reduces liquidation risks and keeps costs at a minimum. Liquidity providers can earn rewards for market-making in swap fees and leverage trading fees,

Beamex also features a native liquidity provider asset called the Beamex Liquidity Provider Index Token (BLP). BLP represents an index of assets used to support swaps and leverage trading on Beamex and replaces the liquidity token pairs used to provide liquidity on Beamswap. BLP is composed of ETH (30%), BTC (12%), DOT (5%), GLMR (3%), and USDC (50%). BLP can be minted using any index asset or burned to redeem any index asset. When leverage traders source liquidity by borrowing from the exchange, or more accurately, liquidity providers or BLP token holders, BLP holders earn a profit if such traders suffer a loss, and vice versa.

STELLASWAP

Source:

https://twitter.com/StellaSwap/status/1637786975414673411

StellaSwap is partnering with Algebra to introduce concentrated liquidity to its platform with the launch of Pulsar, a capital-efficient DEX. This model allows liquidity providers to maximize their capital efficiency and potential ROI by concentrating their liquidity in specific price ranges. Pulsar offers users optimal asset prices, low-slippage, and greater yield optimization for LP stakers.

Compared to StellaSwap's V2 hybrid model, Pulsar's concentrated liquidity model provides LPs with up to 4,000x capital efficiency, liquidity utilization rates beyond 100%, and ultra-low slippage trade execution. Pulsar's fee structure is variable, dependent on factors like volatility, and the average swap fee is expected to range from 0.1% to 0.15%. The revenue breakdown for StellaSwap will be 78% for LP stakers, 12% for xSTELLA holders, 8.5% for the treasury, and 1.5% for V3 devs.

Source:

https://twitter.com/StellaSwap/status/1640029780350472192

The launch of Pulsar is a major milestone for StellaSwap and is set to take place by the end of October/November. Concentrated liquidity has proven to be a game-changer for DEXs, and StellaSwap's implementation through Pulsar will enable the platform to maximize liquidity utilization, provide sufficient liquidity for stakeholder operations, manage emissions effectively, and improve user experience. Adding more sauce, Stella Migrator is Live. Convert your standard AMM (V2) LP into Pulsar (V3) LP in just a click.

For more detailed information about Pulsar, visit

https://docs.stellaswap.com/

.

Prime Protocol

Prime Protocol offers a comprehensive solution for managing liquidity needs in the DeFi space. As an Apes, you can deposit a variety of supported assets into Prime, which operates across multiple chains. This provides access to a single line of credit, backed by the combined value of your portfolio. This solution is natively cross-chain, meaning that regardless of the type of token or the blockchain it is on, your assets will be leveraged to provide you with the liquidity you need. This eliminates the need to manage individual asset-based loans and allows you to focus on maximizing yields.

Prime Protocol is currently conducting a test-net with over 42,000 unique addresses participating. During the test-net, Prime Protocol has expanded to multiple chains, including Arbitrum, Optimism, Avalanche, Polygon, Binance Smart Chain, Moonbeam, and Fuji. To participate in the test-net, access the Prime Protocol app at

https://app.primeprotocol.xyz/

. Detailed information about the test-net can be found here.

RMRK

The Singular NFT Marketplace by RMRK is introducing a new feature called Nested Royalties. This feature pertains to the royalties earned by Nested NFTs, which are collections of NFTs contained within a single parent NFT.

To ensure that each creator's royalty is fairly calculated, the new feature requires that each NFT in a bundle for sale has a set price. This process is made easy with the user-friendly interface that uses sliders to adjust the percentage and calculates the amount automatically. The seller only needs to specify the total price and distribute it among the NFTs in the bundle.

Please note that all NFTs with creator royalties must have a set percentage, and the total percentage of parent and child NFTs must equal 100%. This requirement is automatically enforced, making the process seamless for the seller. Detailed information about the Nested Royalties eature can be found here

To follow the latest developments of the Moonbeam & Moonriver ecosystem, please visit dtmb.xyz